Owning a converted campervan is more than just designing and creating your dream camper; it’s about embracing a lifestyle of adventure and...

Category: Insurance Benefits

Introduction to Insurance for Self-Build Campervans

We’ve put together this quick guide on how to get the right vehicle insurance for your self-built campervan conversion, to make it easier for you to...

Campervan Insurance Considerations: Solar Panels, Pop-Tops & Reverse Cameras

Converting a van into a campervan, often known as a DIY campervan or van conversion, is an exciting and rewarding project. However, it’s essential...

Campervan Conversions, Implications for Insurance

So, you’ve purchased a bog-standard panel van and are in the throes of preparing it for conversion, or you’ve arranged for it to be professionally...

More About Camper Breakdown Cover from Just Kampers Insurance

Breakdown cover for your campervan or motorhome is just a phone call away if you’re insured with Just Kampers Insurance. Whether you’re heading to a...

All about Laid Up Cover with Just Kampers Insurance

With many people taking their classic VWs off the road for the winter, we thought it was time to explain more about the laid up insurance cover...

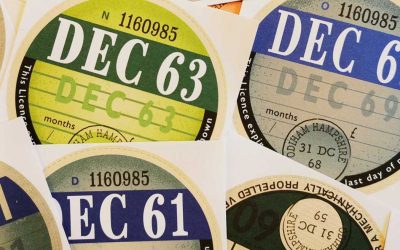

Campervan and Motorhome Vehicle Tax (VED) – Road Tax Guide

VED or vehicle tax can be a confusing topic, especially for future campervan owners. We’ve broken down everything you need to know, and how much you...

Agreed Value from Just Kampers Insurance

No one wants to think about their pride and joy being written off for any reason, especially if it’s a classic car or modified vehicle that you’ve...