Classic campervan insurance

Get the best camper cover with the UK’s only campervan insurance specialists.

Carefully curated to meet your requirements

Get the right cover to keep your classic camper protected.

Classic Camper Van Insurance

Policy Benefits

Classic Campers We Cover

FAQs

Prices start from just

£115

A year, with an option to spread the cost too.

Why choose Just Kampers Insurance for your classic camper?

Just Kampers Insurance has been providing competitive campervan insurance since 1998, so we know exactly how to get you the best deal on insuring your classic camper.

We’ll offer you a selection of hand-picked camper van insurance quotes from our trusted network of insurers, so you can choose the policy which works best for you and your camper.

All of our policies are tailored to your individual needs, meaning you can use your camper exactly as you please. Whether you’re seeking a limited mileage policy or a policy that lets you drive your camper on a grand adventure around Europe, we can help.

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

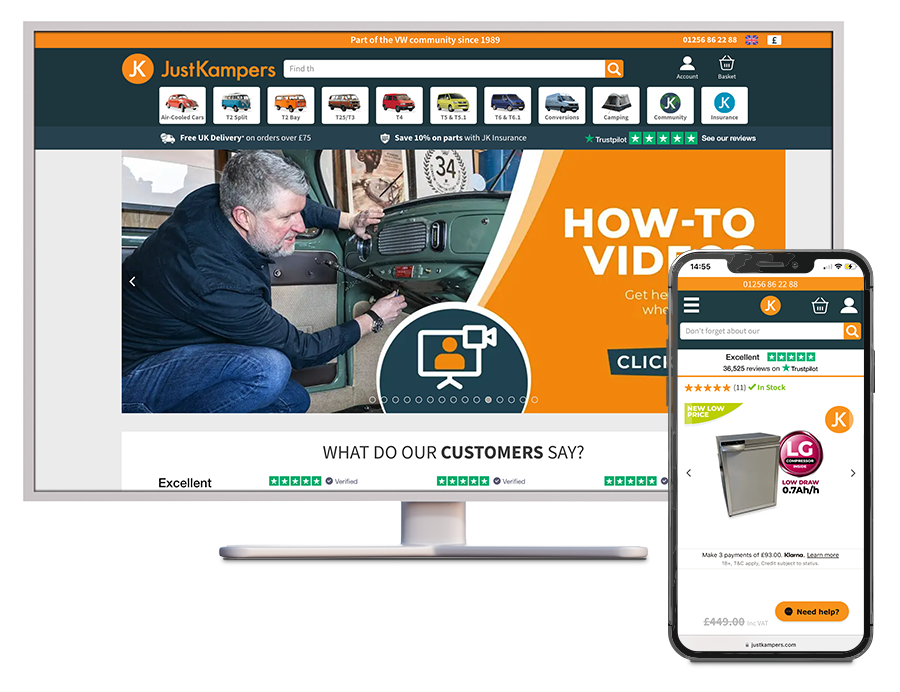

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Classic Camper Insurance Specialists

We got started as classic campervan insurance specialists back in 1998, offering tailored insurance policies for VW campers, but we can offer you unbeatable cover regardless of which camper you’ve got.

From Bedfords to Volkswagens, we’ve got you covered!

There’s a few of the different classic campervans we can insure:

- Bedford CA

- Bedford CF

- Bedford Dormobile

- Chevrolet G20

- Commer Campervans

- Dodge Ram Sportsmobile

- Elddis Autoquest

- Ford Transit Mk1

- Ford Transit Mk2

- Mercedes 407D

- Mercedes Compass Commodore

- Talbot Autoquest

- Talbot Express

- Toyota Hiace

This isn’t an exhaustive list, though, so don’t worry if you don’t see your campervan listed above.

Just give us a call on 01256 444 546 or click here to arrange for us to call you back at a time which works for you.

Modified Classic Camper Insurance

We understand that classic campers are rarely kept exactly how they were first created, and so we offer cover for a huge range of campervan modifications.

Our friendly team of experts includes a huge number of campervan owners, and so we understand the importance of making your camper your own, whether you converted it yourself or made changes to an existing camper.

Instead of compromising on price or quality of cover, as you might need to with another insurer, come straight to Just Kampers Insurance – we have the knowledge and expertise to find you tailored insurance cover without the hassle.

Modifications we can cover include:

- Engine performance modifications

- Suspension modifications / Air-ride

- Fitting of later / more powerful engines

- Non-standard alloy wheels

- Non-standard paintwork

- Interior modifications

- Camper conversions

- Non-standard replacement engines

Save 10% on orders

At JustKampers.com when you insure with Just Kampers Insurance

Pamper Your Classic VW Camper With a Tailored Policy

We offer insurance policies that take the little things into account. You’ll get access to the standard perks of an insurance certificate, but with a few handy extras. Feel confident with cover that helps you go the extra mile.

Standard

Benefits

Included in every policy:

Optional

Benefits

Everything in Standard plus:

Why compromise on insuring your precious vehicle when we'll give you £50* if we are not the cheapest.

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Standard Benefits

Find out more >

Find out more >

Limited Mileage Discount

Our limited mileage discounts can reduce premiums by up to 50% due to the lower risk these represent!

Find out more >

Optional Benefits

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Find out more >

Contents Cover

We'll insure up to £2,000 worth of contents during the insurance period with our contents cover option, so you know your belongings are protected.

Find out more >

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.

Find out more >

Classic Campervan Insurance FAQs

What is a classic campervan?

There’s no firm rule, but at Just Kampers Insurance we tend to classify a campervan as a classic if the engine is in the rear or if it was built more than X years ago.

This means that the VW T2 Splitscreen, VW T2 Bay, and VW T25 would fall under the classic campervan categories, as well as MK2 Ford Transit campers, the Mercedes 407D, the Bedford Dormobile and more!

Luckily, we’re able to provide bespoke vehicle insurance to classic campers or modern ones, as well as daily drivers and a whole host of other vehicles, so no matter what camper you’ve got, or when it was built, you’ll be able to find affordable insurance policies with Just Kampers Insurance.

What are the differences between classic and modern campervan insurance?

Classic campervan insurance policies from Just Kampers Insurance take into account the age, value, and mileage of your camper and are tailored to provide you with great cover at a really affordable price.

We’ve been offering bespoke vehicle insurance quotes since 1998, so we understand that no two campers are the same, and that a classic campervan will be treated different to a modern one.

We understand that your classic camper is likely to be driven less and pampered more than a modern camper might, and these differences are considered when finding you campervan insurance quotes.

Why do I need classic campervan insurance?

It’s incredibly important to keep your classic camper insured, for legal reasons as well as to make sure it’s protected in case something happens to it.

Classic campervan insurance policies from Just Kampers Insurance include Salvage Retention, which gives you the option to retain your vehicle should the worst happen, as well as Limited Mileage Discounts which can reduce your policy’s premium by up to 50%!

How much is classic campervan insurance?

Prices for classic camper insurance start from just £115 with Just Kampers Insurance. Prices will vary, but it’s definitely worth getting a quote from us when you’re looking to get your classic campervan insured.

If Just Kampers Insurance can’t beat your like-for-like vehicle insurance quote, we’ll send you a £50 Just Kampers gift voucher, so it’s a win-win: you either get a great deal on your camper’s insurance, or you get £50 to spend on parts and accessories for it at justkampers.com!