Classic VW Beetle Insurance

Get the best VW Beetle cover from the VW insurance specialists.

Carefully curated to meet your requirements

Get the right cover to keep your VW Beetle protected.

Modified VW Beetle Insurance

Policy Benefits

VW Beetles We Cover

FAQs

Prices start from just

£105

A year, with an option to spread the cost too.

Why Should You Have Dedicated VW Beetle Insurance?

The VW Beetle is an iconic vehicle that first went on the road in the 1940s. Since then, it’s gained a huge following as a classic car, and has been associated with everything from post office delivery vehicles in Germany to taxis in Mexico. It’s important to get the right cover for your pride and joy, whether you want to use it as a daily driver, for weekend trips, or just to take to the occasional Volkswagen show. We offer policies to suit all needs and budgets, from fully comprehensive through to third party fire and theft. We can also offer temporary insurance, which might be the cheaper option for those who only use their VW Beetle every so often.

Whether you have a modern or a classic Beetle, a Beetle Cabriolet, a mint condition vehicle, or a modified VW Beetle like the BAJA bug, Just Kampers Insurance can help. We are experts in Volkswagens, and understand that you might have specific needs – especially when it comes to modifications. Get in touch today for a quote.

Volkswagen Beetle 1945 to 2003 Insurance

Whether your VW Beetle is still in its original form, or it has become a replica of another dream car like a Porsche 550 Spyder, a Beach Buggy, or Porsche 356 Cabrio, we can arrange the right policy for you.

We offer genuine value for money, including a 10% discount at our sister company, Justkampers.com, on parts and accessories. We cover the following models:

Classic VW Beetles We Cover

- Modified air-cooled Volkswagen kit car

- VW Beetle saloon 1945 to 2003

- VW Karmann Beetle convertible 1949 to 1980

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

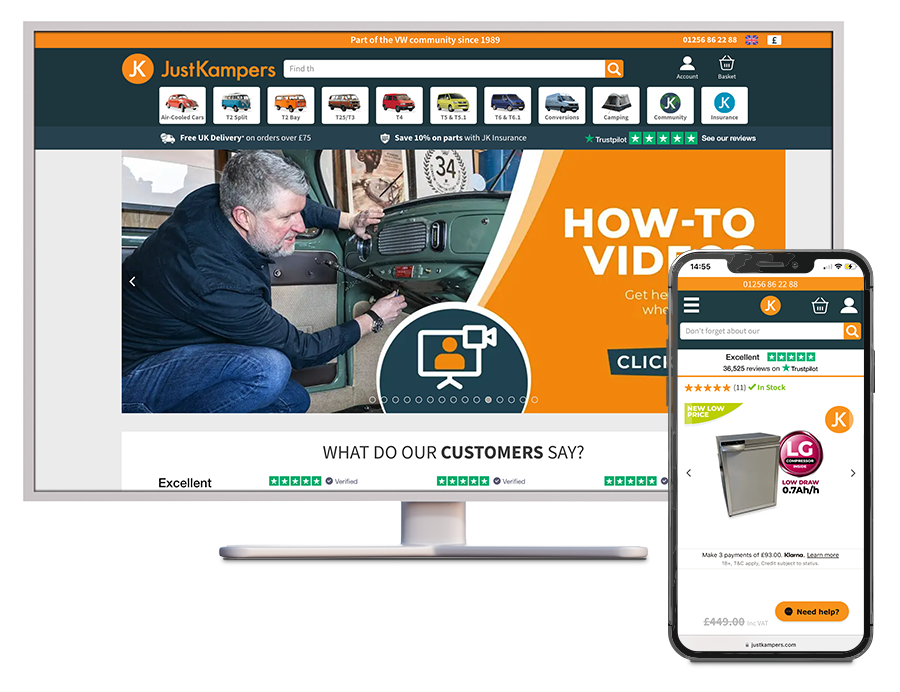

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Modified VW Beetle Insurance

Finding an affordable, good level of cover for your modified VW Beetle can be a challenge. Thankfully, the experts at Just Kampers Insurance understand this, and know how to put together the right policy that allows for a range of different VW modifications. That means you don’t need to compromise on price or quality.

We cover most VW Beetle modifications, including:

- Complete Body Kits

- Fibre glass panels

- Rear Spoiler

- Suspension changes

- Alloy wheels

- Non-standard paintwork

- Flared wheel arches

- Nitrous oxide kit

- Turbocharging

- Non-standard engine replacements

Save 10% on orders

At JustKampers.com when you insure with Just Kampers Insurance

Standard

Benefits

Included in every policy:

Optional

Benefits

Everything in Standard plus:

Why compromise on insuring your precious vehicle when we'll give you £50* if we are not the cheapest.

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Standard Benefits

Find out more >

Find out more >

Limited Mileage Discount

Our limited mileage discounts can reduce premiums by up to 50% due to the lower risk these represent!

Find out more >

Optional Benefits

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Find out more >

Contents Cover

We'll insure up to £2,000 worth of contents during the insurance period with our contents cover option, so you know your belongings are protected.

Find out more >

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.

Find out more >

VW Beetle Insurance FAQs

Why do I need an Agreed Value policy from Just Kampers Insurance?

Agreed Value policies help you to secure the value of your vehicle, rather than take the risk that your payout might be lower than expected in the event of a claim. Should your Beetle be involved in an incident that leads to expensive repairs, it’s declared a write-off, or it gets lost or stolen, you could be in for a nasty surprise upon payment if you haven’t arranged an Agreed Value policy.

Such a policy might also be preferred if you intend to make modifications or carry out restoration works on your VW Beetle. In this case, you’ll want your policy to reflect the true value of the car if it were to be sold, rather than the listed market price at that time.

Does my vehicle insurance policy come with Free Legal Protection?

All our policies come with legal protection automatically. This includes up to £100,000 to cover repairs, hire costs, and legal advice if you are involved in an incident in the UK and Europe that wasn’t your fault. It also affords you extra assistance for claiming for losses not covered by your existing insurance, and for injuries incurred by yourself or your passengers.

What types of VW Beetle do you cover?

As VW specialists, we cover a wide range of VW cars, vans, and campers. We provide insurance policies for all the following Beetles:

- Type 1 (T1)

- Beetle Cabriolet

- Super Beetle

- Bug

- Käfer

- Salon