VW T4 Insurance

Get the best VW T4 cover with the UK’s only campervan insurance specialists.

Carefully curated to meet your requirements

Get the right cover to keep your T4 protected

Modified Vw T4 Insurance

Policy Benefits

T4s We Cover

FAQs

Prices start from just

£225

A year, with an option to spread the cost too.

Why Should You Have Dedicated VW T4 Insurance?

Our VW T4 van insurance can be adapted and specifically tailored to meet your individual needs. Whether you use your T4 Transporter as your daily run-around, drive it across the continent to use as a camper, take it to the occasional VW show, or use it as a works van, we can provide an insurance policy to suit.

The VW T4 is known for being a robust and reliable van, which first debuted back in 1990. Since then, it’s been used by many as a simple work van, a practical motorhome, and modified into a more luxurious leisure vehicle. Regardless of how you see your VW T4, make sure you get the right T4 insurance you need for it, at a fair price.

At Just Kampers Insurance, we pride ourselves on our UK-based team of experts, all of whom understand the varying needs of the VW driver. Our policies are designed to fit all budgets and requirements, covering everything from modifications and contents cover, to Agreed Value insurance.

Volkswagen T4 1992 to 2003 Insurance

The VW T4 was first built in Hannover, Germany between 1990 and 1992. They then replaced the rear-engine models until the end of 2003. They were a totally new model with almost no parts being used from earlier VW Transporters. If you are lucky enough to own a T4, we have the right policy for you.

As well as genuine value for money, our policies also come with 10% off parts and accessories at our sister company, Just Kampers.

VW T4 Models We Insure Include:

- VW T4 professionally converted camper

- VW T4 Transporter 1992 to 2003 which has been custom converted

- VW T4 Panel van, regardless if it’s a Standard roof or High top, double doors in the middle, a “Day Van Camper” or the original

- Pick-ups and Crewcab Pickups

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

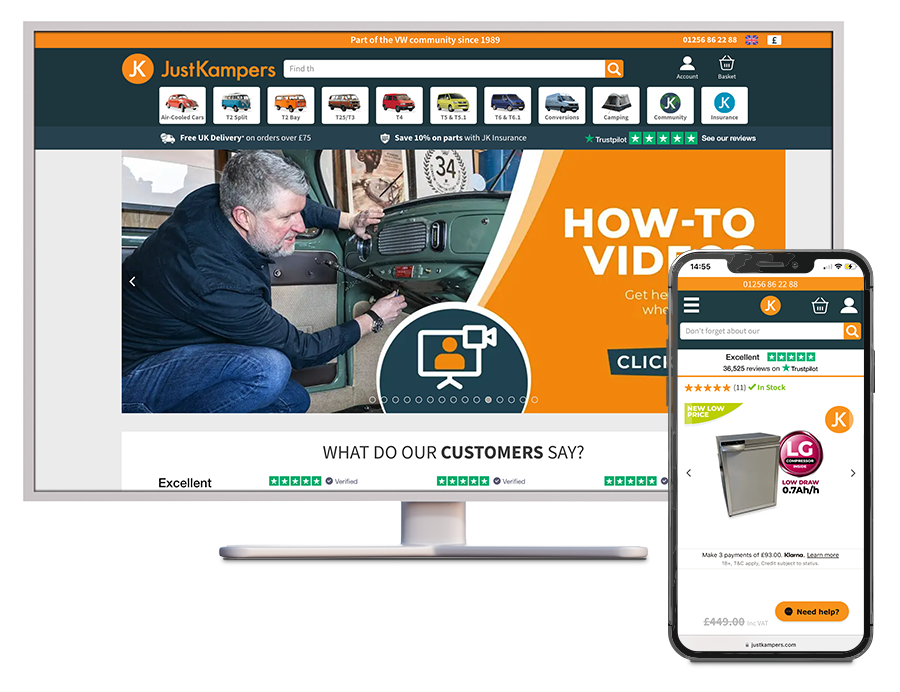

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Modified VW T4 Insurance

If you own a modified T4 and are looking for proper cover for these modifications at a fair price, then you have found the right insurer.

Securing quality insurance for any modified vehicle can be a challenge, and too often, owners of modified campers, vans, or cars need to compromise where price or cover is concerned. At Just Kampers Insurance, however, we understand the passion behind modifying a vehicle to make it more bespoke to you, so we have a deep knowledge of the modified Volkswagen scene.

See the modifications we can insure

- Engine performance modifications

- Airbag suspension

- Swamper look raised suspension

- Fitting of later / more powerful engines

- Suspension changes

- Non-standard paintwork

- Non-standard alloy wheels

- Interior modifications

Save 10% on orders

At JustKampers.com when you insure with Just Kampers Insurance

Pamper Your VW T4 Transporter With a Tailored Policy

We offer insurance policies that take the little things into account. You’ll get access to the standard perks of an insurance certificate, but with a few handy extras. Feel confident with cover that helps you go the extra mile.

Standard

Benefits

Included in every policy:

Optional

Benefits

Everything in Standard plus:

Why compromise on insuring your precious vehicle when we'll give you £50* if we are not the cheapest.

Standard Benefits

Find out more >

Find out more >

Limited Mileage Discount

Our limited mileage discounts can reduce premiums by up to 50% due to the lower risk these represent!

Find out more >

Optional Benefits

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Find out more >

Contents Cover

We'll insure up to £2,000 worth of contents during the insurance period with our contents cover option, so you know your belongings are protected.

Find out more >

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.

Find out more >

VW T4 Insurance FAQs

Why should I opt for an Agreed Value from Just Kampers Insurance?

Agreed Value policies are especially suitable for those who have, or intent to, modify or upgrade their vehicle. This is because, without such a policy you are at risk of your vehicle being undervalued when it comes to insurance pay out, should it be lost, stolen, or written off. With an Agreed Value policy, you’ll receive a fair price that truly reflects the cost of your T4, rather than the market value at that time.

What VW T4s do you insure?

As a VW insurance specialist, at Just Kampers Insurance we provide policies for all Volkswagen T4s:

- Transporter (T4)

- Caravelle

- Eurovan

- T4A

- T4B