Commercial Van Insurance

Get clever with your cover with commercial van insurance from JK Insurance.

Carefully curated to meet your requirements

Get the right cover to keep your Commercial Vehicle protected.

Modified VW Beetle Insurance

Policy Benefits

VW Beetles We Cover

FAQs

Prices start from just

£395

A year, with an option to spread the cost too.

Insurance for commercial, business or company vans

After 20 years of supplying comprehensive and clever business van insurance, JK Insurance has grown in popularity as a leading specialist in tailoring policies with true value. Our policies are competitively priced, and our protection is custom-built to care for your workhorse, no matter where the journey takes it. With a reputation for commercial van insurance in the UK, Just Kampers Insurance can provide your van with the very best cover.

For many, a van is an extension of their job. It’s your travelling companion. No matter where the road takes you for work, you’ll want the comfort that your van is safe and protected against misfortune. Our expert team of advisers match a policy to the person and their van. For every policy, we tailor the details to the vehicle, so it feels right for you.

We provide insurance for business, company, and commercial-use vans in the UK.

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your camper conversion, to short-term temporary insurance.

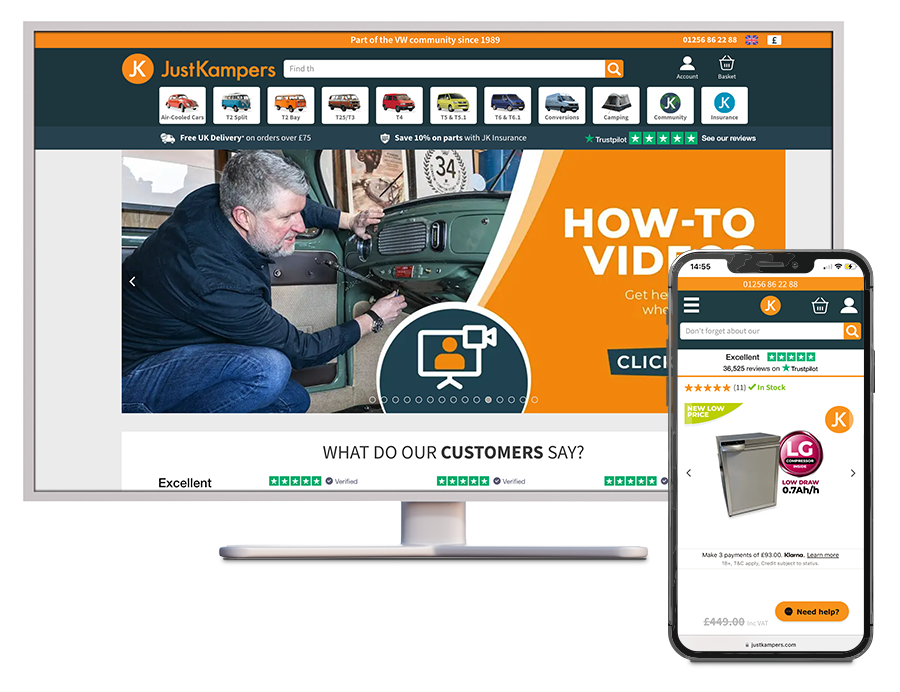

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Commercial vehicle insurance specialists

If you take your work on the road with you, holding a valid insurance policy for your business van is a legal requirement. Yet, if it’s commercially used, a standard policy may not be giving your protection enough mileage.

Commercial vehicle insurance, sometimes known as business van insurance, is a speciality policy that protects vans on work errands or tasks. Unlike traditional policies, which typically covers the driver for social and leisure use, business van insurance extends the reasons a driver is using their vehicle. For example, if you use a van as a courier service to deliver goods.

It’s essential to consider how well your van is protected during work runs. In these moments, a standard policy may leave your vehicle vulnerable. Business van insurance, during commercial commutes and runs, creates added layers of cover in case your vehicle is involved in an accident, or is stolen.

Save 10% on orders

At JustKampers.com when you insure with Just Kampers Insurance

Pamper Your Commercial Van With a Tailored Policy

We offer insurance policies that take the little things into account. You’ll get access to the standard perks of an insurance certificate, but with a few handy extras. Feel confident with cover that helps you go the extra mile.

Standard

Benefits

Included in every policy:

Optional

Benefits

Everything in Standard plus:

Advantages of Choosing Just Kampers Insurance for Commercial Van Insurance

Over 20 years’ experience in the industry

Founded in 1999, JK Insurance has a 20+ year reputation for delivering quality specialist car insurance, and our more senior members of staff have been working in the industry for more than 20 years. With this knowledge, our experts can tailor policies to your commercial, company or business van.

Contents & tool cover

For that added peace of mind that, if your van’s contents are stolen or lost in a fire, any of your insured items will remain covered by your policy. Add up to £2,000 of additional protection to your cover, which will be guaranteed in a lump sum on the policy maturing. This ensures that your personal effects, not only your vehicle, are covered in your policy.

Modification cover

While many van modifications will be around adding space or seats and the like, changing the exhaust and chipping the engine still counts as it would for a modified car. Customising vans is becoming more and more common and these changes most certainly count as modifications, you’ll need to consider upgrading for our modifications cover. Just Kampers are one of the leading modified car and van insurance providers in the UK, so we are able to find you a suitable policy at a fair price.

Standard Benefits

Find out more >

Find out more >

Limited Mileage Discount

Our limited mileage discounts can reduce premiums by up to 50% due to the lower risk these represent!

Find out more >

Optional Benefits

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Find out more >

Contents Cover

We'll insure up to £2,000 worth of contents during the insurance period with our contents cover option, so you know your belongings are protected.

Find out more >

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.

Find out more >

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your camper conversion, to short-term temporary insurance.

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Commercial Van Insurance FAQs

How much does commercial van insurance cost?

Our commercial van insurance prices start from £195 a year. Our policies are tailored to your specific circumstances, so no two quotes will be the same and the exact cost of your policy will depend on a number of factors.

In determining your insurance premium we’ll consider a number of things; including the make and model of your commercial vehicle, any modifications, security, annual mileage and driver history.

Do you offer any discounts?

We offer, discounts for limited mileage, and discounts for after-market security applied to your commercial van.

Do you need business /commercial insurance to drive a van?

If you’re driving in the UK for commercial reasons rather than for leisure, then you’ll need to legally secure the right kinds of protection. For business, company, or commercial vans, this means you’ll need business vehicle insurance as it layers in added protection that keeps your van safe against further misfortunes.

Who does commercial van insurance?

Whilst there are advisers offering traditional insurance policies in the UK, not all protection is adequate or valuable enough for commercial van drivers. It’s distinguished from personal or leisure use and you’ll need a more comprehensive policy that secures your van for work routines and chores. A commercial van insurance policy is designed to enhance the level of your protection, offering extra securities for added confidence.

Are you driving on behalf of someone else?

If you’re in the trade of long hauls, either as a courier or a delivery truck, then having the proper policy is key. These kinds of larger transports will need commercial vehicle insurance.

What are you carrying in your van?

If you’re transporting tools or goods that are essential to your trade, it’s critical that you secure a commercial policy. In the scenario that your van is transporting stock or valuable goods for delivery, holding a policy that protects commercial use can save you time, money, and hassle.

Am I carrying personal or commercial goods?

Are you travelling with goods or people as a service? In essence, if you’re on the road for commercial reasons, rather personal ones, than you’ll need to legally secure commercial vehicle insurance.

Clever cover for commerce

The details of a policy – the level of cover and your premiums – will change between providers. Having a clever cover policy means tailoring your protection to your van and your style of work. It helps to ask yourself:

- What type of van do you own?

- How are you using your van?

- What type of business are you involved in?

- How much are you expecting to use the van?

Switch providers – in moments…

Empowered through a protective policy, our drivers and their vans feel comfortable and confident with their level of cover. Nowadays, you can swiftly switch over between providers and secure that confidence with a more comprehensive policy.