Specialist motorhome insurance

Get specialist motorhome insurance from Just Kampers Insurance, with a quote in minutes from our friendly team of experts.

Carefully curated to meet your requirements

Get the right cover to keep your motorhome protected.

Policy Benefits

Motorhomes We Cover

FAQs

Prices start from just

£225

A year, with an option to spread the cost too.

Bespoke Insurance for motorhomes

We can offer you specialist insurance for your motorhome, which is tailored to you and your motorhome. Just Kampers Insurance has been offering great motorhome insurance since 1998, so you know you’re in good hands.

We understand that there’s a huge number of different motorhomes out there, and everyone uses them differently, which is why we take the details you give us and go off to our network of trusted insurance providers to get you a selection of the best deals on motorhome insurance available anywhere.

Get a Quote on Motorhome Insurance in minutes

It takes no time at all to get a motorhome insurance quote from Just Kampers Insurance, whether you get a quote and buy online, or you give our friendly team of experts a call on 01256 444546.

We’ll take your details and return you a selection of the very best quotes available anywhere, so you can pick the one which works best for you.

Motorhomes we insure

There are dozens of different motorhome manufacturers out there, each with a multiple different models available, and we’re proud to say we can insure all of them.

Here’s a list of a few of the most popular motorhome makes which we cover, although it’s far from an exhaustive list.

If your motorhome isn’t listed here then don’t worry, we can still insure it – just get a quote or give us a call to see how much you could save on motorhome insurance with Just Kampers Insurance.

Below are a few examples of the motorhomes we cover:

Ace

Adria

Auto-Sleeper

Auto-Trail

Autocruise

Bailey

Benimar

Bessacarr

Burstner

Carado

Carthago

Chausson

Cl

Coachman

Coachman

Compass

Dethleffs

Dreamer

Elddis

Etrusco

Frankia

Mclouis

Mobilvetta

Niesmann and Bischoff

Pilote

Rapido

Rimor

Roller Team

Romahome

Sun Living

Sunlight

Swift

Trigano

Trigano

Weinsberg

Wildax

And many more! Don’t worry if you don’t see your motorhome on this list, we can still insure you – get a motorhome insurance quote online, or give us a call on 01256 444 546

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

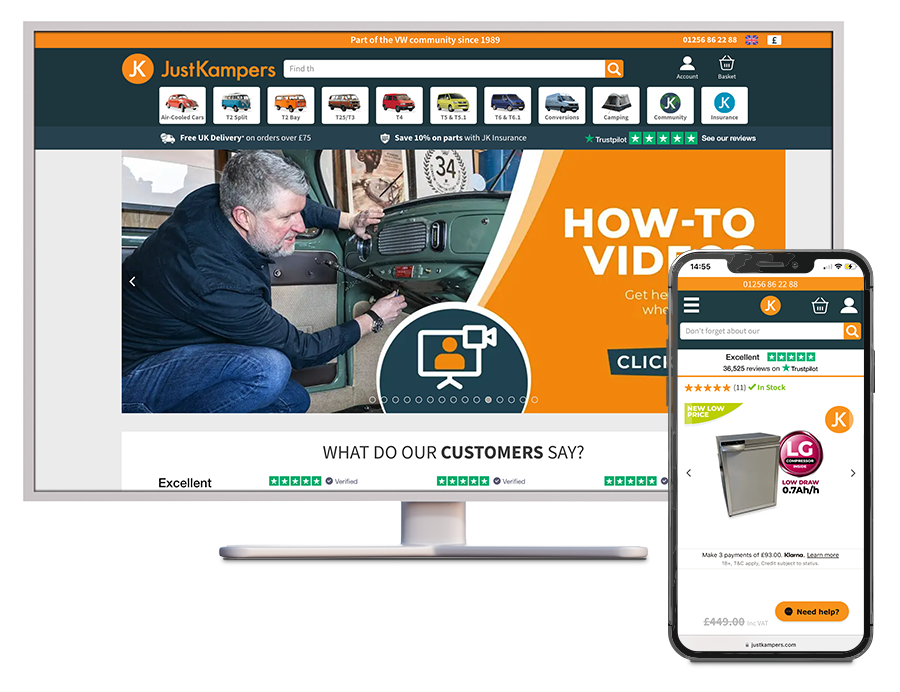

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Pamper Your Motorhome With a Tailored Policy

We offer insurance policies that take the little things into account. You’ll get access to the standard perks of an insurance certificate, but with a few handy extras. Feel confident with cover that helps you go the extra mile.

Standard

Benefits

Included in every policy:

Optional

Benefits

Everything in Standard plus:

Save 10% on orders

At JustKampers.com when you insure with Just Kampers Insurance

Standard Benefits

Find out more >

Find out more >

Limited Mileage Discount

Our limited mileage discounts can reduce premiums by up to 50% due to the lower risk these represent!

Find out more >

Optional Benefits

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Find out more >

Contents Cover

We'll insure up to £2,000 worth of contents during the insurance period with our contents cover option, so you know your belongings are protected.

Find out more >

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.

Find out more >

Why compromise on insuring your precious vehicle when we'll give you £50* if we are not the cheapest.

Motorhome Insurance FAQs

Is motorhome insurance a legal requirement?

Yes, motorhome insurance is a legal requirement in the UK. Like any other vehicle on the road, you must have at least third-party insurance to drive or park your motorhome on public roads. This type of coverage protects you if you cause injury or damage to another person, vehicle, or property. Operating your motorhome without insurance can lead to severe penalties, including fines, points on your driving licence, and even having your vehicle seized.

Motorhome insurance can be tailored to meet your needs, with options for comprehensive coverage that protects against theft, accidental damage, and even personal belongings. Specialised motorhome insurance policies often include features such as European travel cover, breakdown assistance, and coverage for camping gear.

When choosing a policy, it’s crucial to ensure you have adequate protection for both the vehicle and your lifestyle needs. With Just Kampers Insurance, you can access bespoke motorhome policies designed to suit various requirements, ensuring legal compliance and peace of mind while travelling.

For more details, visit Just Kampers Motorhome Insurance.

What type of insurance is required for a motorhome?

In the UK, a motorhome must have at least third-party insurance to be legally driven or parked on public roads. This is the minimum level of cover required by law and protects you if you cause injury to other people, damage their property, or damage another vehicle. However, many motorhome owners opt for more comprehensive coverage to protect their vehicle and lifestyle fully.

A comprehensive motorhome insurance policy typically includes coverage for accidental damage, theft, fire, and vandalism. It can also extend to cover personal belongings, contents inside the motorhome, and camping equipment. Additionally, some insurers offer policies that include European travel cover, breakdown assistance, and cover for alternative accommodation if your motorhome becomes uninhabitable.

Specialist motorhome insurance policies are designed with the unique needs of motorhome owners in mind, often including optional extras like protection against damp, water damage, and tailored breakdown cover.

To ensure you have the right level of protection for your motorhome, explore tailored insurance options with Just Kampers Insurance. Visit Just Kampers Motorhome Insurance for more information.

Can I insure my motorhome as part of a multi-vehicle policy?

Yes, you can often insure your motorhome as part of a multi-vehicle policy, depending on the insurer. A multi-vehicle policy allows you to insure multiple vehicles under one policy, including cars, motorbikes, and motorhomes. Here’s what you need to know:

- Benefits of Multi-Vehicle Policies: Combining your motorhome and other vehicles under one insurance policy can offer cost savings and convenience. Many insurers provide discounts for multi-vehicle policies, reducing your overall premium.

- Eligibility: Not all insurance providers offer motorhome cover as part of a multi-vehicle policy. It’s important to check with your insurer or choose a specialist provider like Just Kampers Insurance, which offers flexible motorhome insurance options that may include multi-vehicle coverage.

- Single Renewal Date: A key advantage of multi-vehicle policies is having a single renewal date for all your vehicles, simplifying management and avoiding the hassle of multiple renewals.

- No-Claims Bonus: Some insurers allow you to share your no-claims bonus across multiple vehicles, potentially leading to further savings.

- Customisation: Multi-vehicle policies can often be tailored to suit different vehicle types, offering the right level of cover for each vehicle.

For more details on whether you can insure your motorhome as part of a multi-vehicle policy, visit Just Kampers Insurance for expert advice and flexible coverage options.

Can I drive a motorhome on my car insurance?

Generally, standard car insurance does not cover driving a motorhome. Motorhomes are distinct from regular cars in terms of size, usage, and value, requiring specialised insurance tailored to their unique needs. Attempting to drive a motorhome under standard car insurance coverage could leave you uninsured and at risk of severe penalties, including fines, points on your licence, or the vehicle being seized.

To legally drive a motorhome, you need a dedicated motorhome insurance policy. This type of coverage can be tailored to your specific needs, providing protection for the vehicle itself, its contents, and potential risks associated with travel. Comprehensive policies often include coverage for theft, accidental damage, fire, and even personal belongings inside the motorhome. Optional add-ons such as European travel cover and breakdown assistance are also available.

For peace of mind and compliance with the law, consider a specialised motorhome insurance policy through a provider like Just Kampers Insurance. It ensures you have appropriate coverage for your motorhome adventures. Visit Just Kampers Motorhome Insurance to learn more.

Can I get temporary motorhome insurance?

Yes, you can get temporary motorhome insurance, offering flexible coverage for short-term needs. Temporary motorhome insurance provides protection for a specified period, typically ranging from one day up to several weeks or months. This type of policy is ideal if you need to borrow a motorhome for a holiday, move a motorhome between locations, or use it occasionally without committing to an annual policy.

Temporary motorhome insurance often offers comprehensive coverage, including protection against theft, accidental damage, and third-party liability. It can also include options for European travel or breakdown assistance, depending on the insurer and policy terms.

Using temporary motorhome insurance ensures you’re legally covered to drive the vehicle and offers peace of mind without long-term commitments. It’s essential to check the terms and conditions of any temporary policy to understand the coverage limits and exclusions fully.

For tailored solutions and reliable coverage, call Just Kampers Insurance for a flexible motorhome insurance quote, including temporary cover designed to suit your short-term needs. Visit Just Kampers Motorhome Insurance for more details.

Can I add an additional driver to my motorhome insurance policy?

Yes, you can add an additional driver to your motorhome insurance policy. Most insurance providers, including specialist motorhome insurers, allow you to include additional drivers to your policy, making it more convenient for shared driving responsibilities during trips or holidays.

Adding an additional driver may impact your premium depending on the driver’s profile, such as their age, driving experience, and claims history. For example, if the additional driver has a clean driving record and significant experience, the impact on your premium may be minimal. Conversely, if the driver is young or inexperienced, it could lead to a higher premium due to increased perceived risk.

To add an additional driver, you will need to provide relevant details, including their name, date of birth, driving licence information, and any relevant driving history. Be sure to disclose accurate information to avoid invalidating your policy.

For tailored motorhome insurance options, including adding additional drivers, call Just Kampers Insurance. They can help you find the best solution to suit your needs. Visit Just Kampers Motorhome Insurance for more information.

What happens if my motorhome is written off?

If your motorhome is written off, it means the cost to repair the damage exceeds its value, or it is beyond repair. Here’s what happens next:

- Insurance Valuation: Your insurer will assess the motorhome and provide a settlement value based on its market value at the time of the incident. This value is typically determined by factors such as the motorhome’s age, condition, mileage, and current market demand.

- Payout Process: Once your motorhome is deemed a write-off, you’ll receive a payout. If you have a “new for old” policy, you may be offered the cost of a brand-new replacement if your motorhome is relatively new. Otherwise, you’ll get a payout based on the motorhome’s current value.

- Outstanding Finance: If there’s outstanding finance on the motorhome, the payout will first go toward paying off any remaining balance. If the payout exceeds the finance amount, you’ll receive the difference.

- Retention Option: In some cases, you may be given the option to retain the salvage and keep the damaged motorhome, typically for parts, but at a reduced settlement amount.

For more detailed information on motorhome insurance and what happens if your motorhome is written off, visit Just Kampers Insurance. We offer tailored policies to ensure you’re covered in the event of a total loss.

Does motorhome insurance cover water damage?

Motorhome insurance can cover water damage, but it depends on the specifics of your policy. Most comprehensive motorhome insurance policies provide coverage for sudden and accidental water damage, such as leaks caused by storms, burst pipes, or external flooding. However, coverage can vary, so it’s crucial to review the terms and conditions carefully.

Water damage resulting from gradual wear and tear, poor maintenance, or pre-existing issues may not be covered by standard policies.

It’s essential to regularly maintain your motorhome to minimise water-related issues and ensure compliance with policy requirements. If water damage occurs, document the damage, take preventative measures to mitigate further harm, and contact your insurer promptly to make a claim.

For tailored coverage and peace of mind, Just Kampers Insurance offers policies that can include protection against a range of risks, including water damage. Visit Just Kampers Motorhome Insurance for more details on policy options.

Can I transfer my no-claims bonus (NCB) from my car to my motorhome?

Yes, in many cases, you can transfer your no-claims bonus (NCB) from your car to your motorhome. However, this depends on the specific insurer and their policies. Some motorhome insurance providers will allow you to transfer your NCB from a car, while others may not. Here’s what you need to know:

- Insurer Policies: Some insurance companies recognise the no-claims bonus earned on your car when applying for motorhome insurance, which can significantly reduce your premium. However, it’s important to check with your insurer, as policies vary between providers.

- Partial Transfer: Some insurers might allow you to use your NCB for either your car or motorhome, but not both at the same time. This means if you transfer the NCB to your motorhome, your car may not benefit from the discount.

- Specialist Providers: Some insurers specialising in motorhome insurance, like Just Kampers Insurance, may offer additional flexibility with NCB transfers. They may even offer competitive rates for new motorhome owners who have a strong claims history with their car insurance.

- No-Claims Bonus Protection: If your NCB is important to you, consider a policy that offers NCB protection, ensuring you don’t lose your discount if you need to make a claim.

For more advice and to explore NCB transfer options for your motorhome, visit Just Kampers Insurance today.

Can I suspend my motorhome insurance over winter?

While some insurance providers may offer options to suspend motorhome insurance over winter, it’s not always recommended. Here’s what you need to know:

Laid-Up Cover: Some insurers offer “laid-up” or “storage” insurance, which provides coverage for fire, theft, and accidental damage while your motorhome is not being driven. This can help you reduce costs while your motorhome is parked up during the winter months. However, it won’t cover any incidents that occur if you decide to drive your motorhome during this period.

SORN Declaration: If your motorhome will be off the road, and you plan to suspend insurance, you must file a Statutory Off Road Notification (SORN) with the DVLA. This declares your vehicle as not being driven, meaning it doesn’t need road tax or insurance. Keep in mind, though, that without insurance, your motorhome won’t be protected from risks like theft or fire.

Maintaining Comprehensive Cover: While suspending insurance might save money in the short term, keeping comprehensive cover ensures your motorhome remains protected year-round, even in storage. Many insurers offer discounts for reduced mileage during off-season periods.

Always consult your insurer to explore options. For flexible and reliable motorhome insurance, including possible winter storage options, visit Just Kampers Insurance.

Can I get a discount if I don’t use my Motorhome often?

How much does secure motorhome storage cost?

The cost of secure motorhome storage varies depending on factors like location, type of storage facility, and the level of security offered. On average, secure storage can range from £30 to £70 per month in the UK, though prices can be higher in areas with high demand or in facilities offering top-tier security features.

Storage facilities designed specifically for motorhomes often provide added benefits such as CCTV surveillance, gated access, 24/7 security, and covered or indoor parking options. The higher the level of security and convenience, the more it may cost.

While secure storage represents an additional expense, it can lead to savings on your motorhome insurance. Many insurers offer discounts for storing motorhomes in recognised secure facilities, as it significantly reduces the risk of theft or vandalism.

Before choosing a storage option, assess the level of security, proximity to your home, and accessibility of the facility. Contact your insurer to understand any potential discounts that may apply for using secure storage.

For tailored insurance solutions and advice on reducing premiums through secure storage, call Just Kampers Insurance or visit Just Kampers Motorhome Insurance for more details.

How can I save on my motorhome insurance?

To save on your motorhome insurance, there are several strategies you can use to lower your premiums while still getting the right coverage. Here are some tips:

Limit Your Mileage: Insurance providers often offer lower premiums if you commit to a lower annual mileage. If you only use your motorhome a few times a year, reducing your mileage estimate can save you money.

Increase Your Voluntary Excess: Opting for a higher voluntary excess (the amount you pay in the event of a claim) can reduce your premium. Just ensure the excess is an amount you’re comfortable paying.

Join a Motorhome Club: Many insurers offer discounts if you’re a member of a recognised motorhome or campervan club. These clubs often work with insurance providers to offer special rates.

Improve Security: Adding extra security features, such as tracking devices, immobilisers, or alarms, can lower your premium by reducing the risk of theft.

No Claims Discount: Just like car insurance, building up a no-claims discount over time can lead to significant savings.

Park in a Secure Location: Parking your motorhome in a secure location, like a garage or secure storage facility, can reduce your risk profile and lower your insurance cost.

For more information and tailored advice on how to save on your motorhome insurance, visit Just Kampers Insurance and get the coverage you need at the best price.

How do I estimate mileage for my motorhome?

Estimating mileage for your motorhome is important, especially when getting motorhome insurance, as many providers base premiums on annual mileage. Here’s how to estimate your motorhome’s mileage accurately:

Review Past Usage: If you’ve owned your motorhome for a while, check previous MOT records or logbooks to get a sense of how many miles you typically cover each year. This historical data can help you predict future mileage.

Plan Your Trips: Think about your upcoming travel plans. Estimate the distance for each trip, including local drives and longer journeys. For example, a UK road trip might add 1,000 to 3,000 miles, while continental trips could add significantly more.

Frequency of Use: Consider how often you use your motorhome—whether it’s just for a few summer trips or frequent weekend getaways. Regular use throughout the year will naturally lead to higher mileage compared to occasional trips.

Seasonal Factors: Many motorhome owners use their vehicles more during the summer months. If you primarily travel during this time, you can adjust your estimate accordingly.

To avoid over- or under-estimating, be realistic with your driving habits. Estimating accurately can help ensure you get the right insurance coverage at a fair price. For more advice on motorhome insurance and mileage limits, visit Just Kampers Insurance.

What factors can affect my insurance premium?

Several factors can influence the cost of your motorhome insurance premium. One of the main factors is the value, make, and model of your motorhome. Higher-value vehicles typically cost more to insure due to the increased cost of repairs or replacements. Usage patterns also matter; frequent use, long journeys, or using your motorhome for business purposes can raise premiums.

Your driving history and age are significant factors. Drivers with clean driving records and more experience usually benefit from lower premiums, while younger or inexperienced drivers may face higher costs. The location where your motorhome is stored also impacts premiums—secure storage options like garages or specialised facilities often lead to savings.

Additionally, security features, such as alarms, immobilisers, and tracking devices, can lower your premium by reducing the risk of theft. The type and level of coverage you select, including any optional extras like European travel cover, also influence your premium.

Finally, opting for a higher voluntary excess or building up a no-claims bonus over time can further reduce your costs.

For tailored advice and a competitive motorhome insurance quote, call Just Kampers Insurance or visit Just Kampers Motorhome Insurance

What won’t motorhome insurance cover?

Motorhome insurance provides essential protection for your vehicle, but it’s important to understand what won’t motorhome insurance cover. Exclusions can vary depending on the provider and policy, but here are some common scenarios typically not covered by motorhome insurance:

Wear and Tear: General wear and tear or deterioration of your motorhome over time, such as rust or mechanical failure, is usually excluded from coverage.

Unsecured Belongings: Personal belongings left unattended or unsecured inside the motorhome may not be covered, especially if the vehicle is unlocked or left in a high-risk area.

Driving Without a Licence or Under the Influence: Any damage caused while driving the motorhome without a valid driver’s licence, or under the influence of alcohol or drugs, will not be covered.

Commercial Use: If you use your motorhome for business purposes, such as renting it out or using it as a permanent residence, this may not be included under standard motorhome insurance.

Intentional Damage: Any damage caused deliberately by the insured or an authorised driver is typically excluded.

It’s essential to carefully review your policy documents to understand the specific exclusions. For more information on motorhome insurance and to ensure you have the right coverage for your needs, visit Just Kampers Insurance.

How much is road tax on a motorhome?

The cost of road tax on a motorhome in the UK depends on several factors, including the vehicle’s age, weight, and emissions. Motorhomes, also known as campervans, fall under the category of Private/Light Goods (PLG) vehicles if they weigh less than 3,500kg. The current road tax for PLG motorhomes is typically a flat rate of £320 per year (as of 2024).

For heavier motorhomes weighing over 3,500kg, they are taxed under the Private Heavy Goods Vehicle (PHGV) class, which is also a flat rate, currently at £165 per year.

If your motorhome was registered after April 1, 2017, the road tax rate is based on its CO2 emissions. Vehicles emitting higher CO2 levels will incur a higher tax, ranging from £140 to £570 in the first year, and then an annual flat rate of £165 thereafter. Additionally, if your motorhome is classified as a Zero-Emission Vehicle (ZEV), such as an electric motorhome, you may be exempt from paying road tax.

It’s important to check your motorhome’s specific details to calculate the exact road tax. For more information on motorhome ownership and insurance, visit Just Kampers Insurance for expert advice on keeping your campervan road-ready and protected.

Can I live full-time in my motorhome?

Yes, you can live full-time in your motorhome, but it’s important to have the right insurance. Standard motorhome insurance may not provide adequate coverage for full-time living, so you’ll need a specialist policy designed for this lifestyle. Full-time van life insurance offers additional protections for your motorhome or campervan, its contents, and extended use, ensuring you’re covered beyond occasional holidays.

Living full-time in a motorhome also involves specific considerations, such as registering a permanent residential address for legal and postal purposes, as well as ensuring your motorhome is equipped for continuous living with adequate heating, cooking facilities, and secure storage.

When applying for full-time motorhome insurance, be honest about your living arrangements so that you receive comprehensive coverage, including for personal belongings, public liability, and breakdown assistance.

For tailored insurance solutions to fit your full-time motorhome lifestyle, call Just Kampers Insurance. Visit Just Kampers Motorhome Insurance or explore Just Kampers Vanlife Insurance for coverage options designed for full-time travellers.

How do I figure out how much my contents are for my motorhome policy?

To determine how much your motorhome’s contents are worth for your insurance policy, start by making an inventory of all items you keep in the motorhome. Include personal belongings, kitchenware, camping gear, electronics, furniture, and any other valuable items. List each item, noting its current value or replacement cost, which may differ from the purchase price if the item has depreciated over time.

Once you have a comprehensive list, calculate the total value of all items. It’s important to be thorough, as underestimating your contents’ value can leave you underinsured, while overestimating may increase your premium unnecessarily.

Ensure that your insurance policy covers high-value items separately if required, as some policies may have limits on single-item values. Optional coverage add-ons can extend protection for items that may not be included in standard contents insurance.

For personalized advice and help calculating the contents value for your motorhome insurance policy, contact Just Kampers Insurance. They can provide tailored coverage solutions to ensure your contents are adequately protected. Visit Just Kampers Motorhome Insurance for more information.

How can I find out my motorhome's first registration date?

To find out your motorhome’s first registration date, start by checking your V5C logbook, also known as the vehicle registration certificate. This document, issued by the DVLA, contains essential information about your motorhome, including the exact date it was first registered. The registration date is typically listed under the “Date of First Registration” section on the front page.

Alternatively, if you don’t have access to your V5C logbook, you can find this information by contacting the DVLA directly. You may need to provide details such as the vehicle’s registration number, make, and model. Some online services also allow you to check vehicle registration details using the registration plate.

Knowing your motorhome’s first registration date is important for insurance purposes, road tax, MOT requirements, and understanding its history.

For tailored motorhome insurance solutions, including advice and coverage that fits your motorhome’s age and condition, call Just Kampers Insurance. Visit Just Kampers Motorhome Insurance for more information.

Why do I need an Agreed Value benefit from Just Kampers Insurance?

Arranging an Agreed Value policy is simple and keeps you financially protected. If your motorhome or campervan has been upgraded or modified at substantial expense, you can make sure this cost is protected by pre-agreeing a value that reflects your changes. All you need to do is present evidence of such additions, and we will work with you to come to a fair price. Once this is agreed upon, we’ll provide appropriate certification to give you added peace of mind.

What does Just Kampers Insurance legal protection include?

We automatically include legal protection in all of our policies to provide you with extra assistance should you be involved in an incident that was not your fault (in the UK or Europe). Our legal protection offering includes:

- Up to £100,000 for legal expenses, repairs, and the cost of a hire vehicle

- Legal assistance for claiming compensation for injury or losses for both the driver and any passengers

- Help and advice in claiming for any losses that aren’t covered by your existing insurance

- Where possible, like-for-like vehicle replacement to keep you moving

- Access to helplines

If you have any questions about our legal protection, call the team on 01256 444546 if you have further questions.

Is it expensive to insure a campervan or motorhome?

At Just Kampers Insurance, our prices start from just £129 a year. However, cost will vary from person to person because vehicles, driving history and driving plans differ significantly. Fortunately, to save you money and provide you with the most appropriate cover, we tailor our policies to suit your specific needs and requirements. For example, if you only take your camper out twice a year, we’ll take that into consideration.

Why should I use a specialist campervan and motorhome insurer?

A specialist like Just Kampers Insurance is able to tailor your insurance policy.

Unlike a car, it’s likely you have a lot of contents that need protecting in your camper. Whether it be your electronics, clothes, jewellery, appliances, or furniture, you’ll want to know that they’re protected against loss, fire, and theft. As a specialist insurer, we also offer contents cover to protect your belongings, as well as a multitude of other extras including breakdown cover across Europe and Agreed Value cover.