Latest News

Just Kampers Insurance was setup with the VW enthusiast in mind and has been providing tailored insurance policies for classic VWs and daily drivers for twenty years.

Take a look at our latest news articles and useful articles.

Can I Drive A Campervan On A Car Driver’s Licence?

The answer to this question is dependent on a selection of factors. These include your age, your driving licence type, and the maximum authorised...

Our guide to the annual costs you should know about before you buy a campervan

Looking at buying a campervan? You’re in the right place! We’ve put together this handy guide to the annual costs of owning a camper, so you’re not...

Campervan Conversions, Implications for Insurance

So, you’ve purchased a bog-standard panel van and are in the throes of preparing it for conversion or you’ve arranged for it to be professionally...

More About Camper Breakdown Cover from Just Kampers Insurance

Breakdown cover for your campervan or motorhome is just a phone call away if you’re insured with Just Kampers Insurance. Whether you’re heading to a...

All about Laid Up Cover with Just Kampers Insurance

With many people taking their classic VWs off the road for the winter, we thought it was time to explain more about the laid up insurance cover...

How Much Does a Campervan Conversion Cost?

What is the cost of a campervan conversion? This is the question everyone asks when they think of taking off into the sunset in the campervan of...

Guide to Campervan & Motorhome Tyres – What Should You Use?

Checking your tyres for signs of wear and tear before a trip away should be a vital step for any traveller. Ensuring your campervan or motorhome...

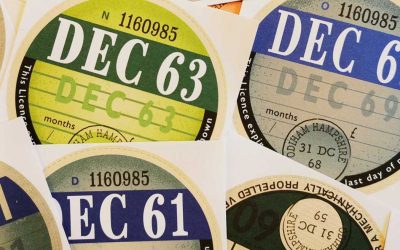

Campervan and Motorhome Vehicle Tax (VED) – Road Tax Guide

VED or vehicle tax can be a confusing topic, especially for future campervan owners. We’ve broken down everything you need to know, and how much you...

Agreed Value from Just Kampers Insurance

No one wants to think about their pride and joy being written off for any reason, especially if it’s a classic car or modified vehicle that you’ve...

Why compromise on insuring your precious vehicle when we’ll give you £50** if we are not the cheapest.

Why compromise on insuring your precious vehicle when we’ll give you £50** if we are not the cheapest.

**£50 supplied as Just Kampers Gift Card. Terms & Conditions apply.

Get an online quote in minutes or call us

Monday to Friday from 09:00 - 19:00

Saturday from 09:00 - 14:00

Sunday from 10:00 - 14:00

or Arrange a call back.

CALL US ON 01256 444546

ARRANGE A CALL BACK

Pamper Your VW Daily Driver With a Tailored Policy

We offer insurance policies that take the little things into account. You’ll get access to the standard perks of an insurance certificate, but with a few handy extras. Feel confident with cover that helps you go the extra mile.

Standard Benefits

Get an online quote in minutes or call us

Monday to Friday from 09:00 - 19:00

Saturday from 09:00 - 14:00

Sunday from 10:00 - 14:00

or Arrange a call back.

CALL US ON 01256 444546

ARRANGE A CALL BACK

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Contents Cover

Contents cover insures you for up to £2000 worth of cover during the insurance period, so you know your belongings are protected.

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.