Citroën Dispatch Campervan Insurance

With three body lengths and two wheelbases available, the Citroën Dispatch has been a popular campervan conversion choice for many years thanks to its versatility and comfort. Whatever model your Citroën Dispatch may be, Just Kampers Insurance can provide tailored cover just for you. Discover more.

Carefully curated to meet your requirements

Get the right cover to keep your Citroën Dispatch protected.

Modified Camper Van Conversion Insurance

Policy Benefits

Prices start from just

£290

A year, with an option to spread the cost too.

Why Should You Have Dedicated Campervan Insurance?

Here at Just Kampers Insurance, we truly understand the blood, sweat and tears that have gone into your beloved modified camper.

As campervan owners ourselves, we understand the trials and tribulations that come with all elements of campervan ownership, including finding suitable Dispatch insurance.

That’s why our Citroën Dispatch insurance policies reflect our feelings as campervan owners. Covering a wide breadth of modifications, our insurance policies will provide the cover you need without breaking the bank.

In fact, our insurance policies are so competitive that if we can’t beat another quote, we’ll give you a £50 Just Kampers gift card (terms and conditions apply).

About the Citroën Dispatch Campervan

Akin to the Peugeot Expert or Toyota Proace, the Citroën Dispatch has been a popular choice by drivers and campervan converts alike since its initial launch in 1996.

With a facelift model released in 2001 and the Mark 2 released in 2007, this medium-sized panel van has seen many incarnations since the original model was manufactured during the mid-90s. Now on its third model, released in 2016, the Dispatch still offers great versatility for self-build camper enthusiasts nearly three decades on.

With a payload of 1400kg, three body lengths (XS, M and XL) and two wheelbases available (all with one single roof height!) and two sliding doors for easy access, this panel van boasts flexibility and comfort to be celebrated.

Unveiled in Spring 2020, the electric version of the Dispatch, the e-Dispatch, is now available.

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

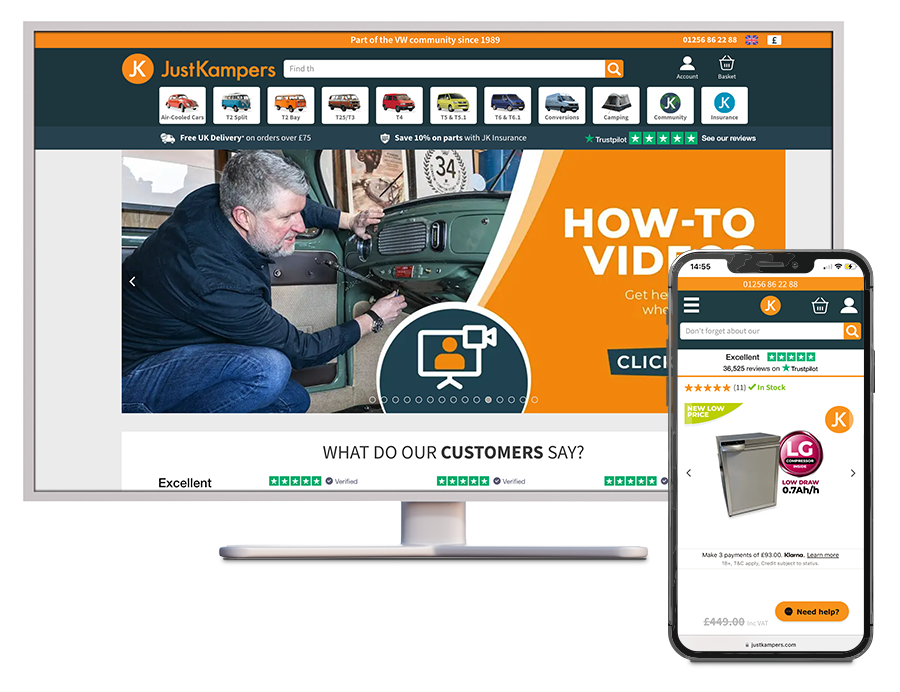

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Citroën Dispatch Campervan Modifications We Cover

Many high street insurers may charge excessive prices to cover your modified Citroën Dispatch, and you may even run the risk of not getting covered at all.

If you are looking to modify your Citroën Dispatch and are concerned that you won’t be covered – fear not. There are many modifications we cover here at Just Kampers Insurance.

Campervan modifications are provided as standard with many of our policies, so you can be safe in the knowledge that the time and effort gone into your modifications can be enjoyed to its fullest.

- Cosmetic changes including spoilers and body kits

- Racking, storage and interiors

- Adding or removing seats

- Adding or removing windows

- Adding different power supplies, split charge & 240v hook up

- Non-standard alloy wheels

- Audio or entertainment upgrades

- Refrigeration

- Suspension modifications Lowering / Air-ride setups / adjustable ride height

- Facelift upgrades

- Engine power upgrades / Remapping

- Non-standard engine replacements

- Paint / Graphics / Body wraps

- Cooking / gas / sink installations

Save 10% on orders

At JustKampers.com when you insure with Just Kampers Insurance

Pamper Your Camper With a Tailored Policy

We offer insurance policies that take the little things into account. You’ll get access to the standard perks of an insurance certificate, but with a few handy extras. Feel confident with cover that helps you go the extra mile.

Standard

Benefits

Included in every policy:

Optional

Benefits

Everything in Standard plus:

Why compromise on insuring your precious vehicle when we'll give you £50* if we are not the cheapest.

Why Choose Just Kampers Insurance?

We offer a range of policy choices and additions designed to suit a range of needs, from Agreed Value cover that protects the true value of your vehicle, to short-term temporary insurance.

Get 10% off all parts and accessories at our sister company justkampers.com

A friendly team, there if you need assistance

Standard Benefits

Find out more >

Find out more >

Limited Mileage Discount

Our limited mileage discounts can reduce premiums by up to 50% due to the lower risk these represent!

Find out more >

Optional Benefits

Agreed Value

It is important to consider an agreed valuation for your campervan, as in some cases, with a recent restoration or upgrade, the listed market value may not reflect the true value that could be reached if you were to sell the vehicle.

Find out more >

Contents Cover

We'll insure up to £2,000 worth of contents during the insurance period with our contents cover option, so you know your belongings are protected.

Find out more >

Breakdown Cover

The cost of not having breakdown cover can be huge due to the high towing costs and call out charges which mean breakdown insurance is almost a necessity.

Find out more >