Looking at buying a campervan? You’re in the right place! We’ve put together this handy guide to the annual costs of owning a camper, so you’re not...

Tag: Campervan

How Much Does a Campervan Conversion Cost?

What is the cost of a campervan conversion? This is the question everyone asks when they think of taking off into the sunset in the campervan of...

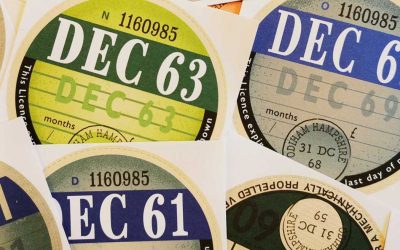

Campervan and Motorhome Vehicle Tax (VED) – Road Tax Guide

VED or vehicle tax can be a confusing topic, especially for future campervan owners. We’ve broken down everything you need to know, and how much you...